At the end of June, the energy price cap will drop by over a third from the current cap, at the same time the wholesale cost of energy has dropped significantly in 2023. These factors will re-introduce dynamics to the energy market that it hasn’t seen in a long time. For providers, this should mean re-focusing on the customer experience (CX), rebooting their sales and retention muscle memory, whilst getting ready to respond to hard-to-predict customer needs.

The return of market dynamics will pose a challenge for suppliers – but it’s also an opportunity for profitable growth.

As someone who’s been working in – and observing – the UK energy market for over 25 years, I feel I’m able to say that energy suppliers are in for a bumpy ride. If competition returns as expected, we could see millions of households starting to shop around for better deals. It’s fair to say that it’ll take the concerted effort of a well-oiled customer experience operation to turn this moment of volatility into an opportunity for growth. But first, let me quickly explain why the situation we’re in is so unique.

A whole new set of market dynamics

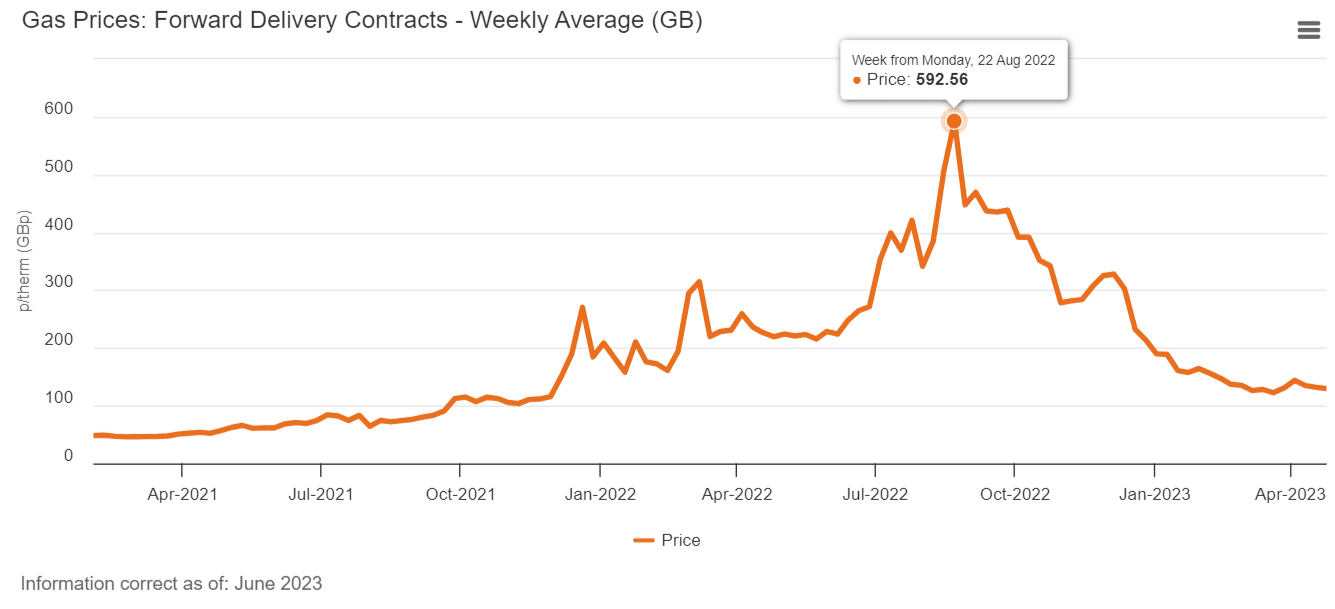

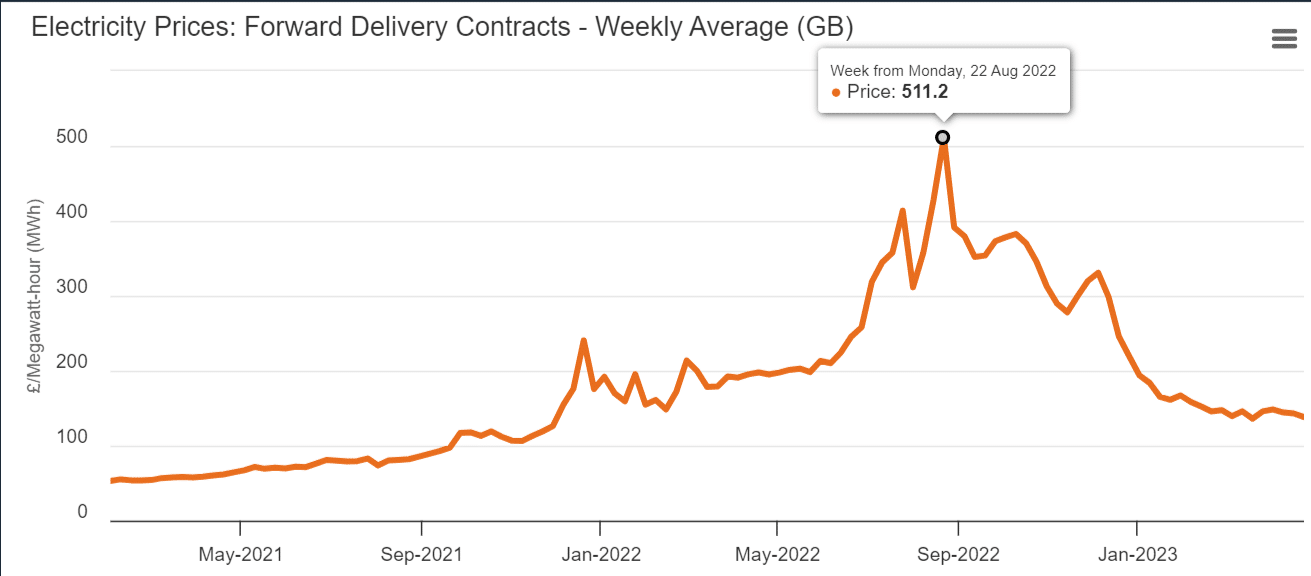

Back in 2019 the government introduced the price cap with the intention of protecting the end consumer from inflated prices. As long as commodity costs were relatively stable there remained many switching options open to the consumer i.e. the market allowed customers to save money by shopping around. From 2021 through to August 2022 we saw an unprecedented increase in cost of energy (due to increased demand post-Covid, and the impact of the war in Ukraine). These extra costs were mostly borne by the end consumer. Despite government support through the Energy Price Guarantee and bill support payments, the increased cost of Energy has been a main contributor to the cost of living crisis we have experienced. Add to those other inflationary impacts, it’s clear that many households are finding themselves extremely strapped for cash.

And while these prices are beginning to come down now, the situation is far from relaxed, for both consumers and energy suppliers: for consumers, because despite the energy cap and government support schemes, they’re still paying over twice per year than they used to; and for providers because their margins tend to be small – and for many of the larger suppliers the collapse of the smaller market players has provided them with an avalanche of new customers that whilst providing market share and revenue come with significant onboarding and admin costs.

Enter: a big dollop of uncertainty

With some potential to create tariffs priced below the cap energy suppliers are entering a period of extreme uncertainty. We know that switching is on its way back, but we don’t know to what extent it will create market movement. Predicting this is challenging for a number of reasons:

- Margin erosion: not all of the “windfall customers” acquired through supplier of last resort process will help suppliers be profitable (31 suppliers have gone bankrupt since the beginning of 2021 impacting over 2 million customers, with a further 1.7 million impacted by Bulb energy entering special administration) – it is probable that the additional cost and burden of onboarding them means most are unprofitable in the current market. Will these displaced customers wish to stay with their new supplier who they did not choose?

- A return of market dynamics: While commodity costs were high, all tariffs defaulted to the price cap, de facto removing competition on price – and consumers’ appetite to switch. We are already seeing marginally competitive tariffs returning to market. It remains to be seen how this develops from July onwards and what savings will be available to the consumer.

- Inflation has left large swathes of consumers with little discretionary income, and many families are spending the bulk of it on fuel and food, sometimes having to choose between the two. If they can see a real opportunity to save money through switching, then surely it’s one of the first things they’ll do

- Consumer advice advocates and money saving experts will soon start coaching the nation on ways to make the most of their options – leaving energy companies to respond. This could create stampede in customer switching.

My view is that unless we see a return of higher commodity costs (events of the last 2 years have demonstrated that we should never count this out), the market could well experience an explosion in switching activity beyond July, even if the savings are relatively modest.

How should energy supplier respond?

And that means: Energy suppliers have their work cut out for them. But if they approach the situation and their customers in the right way, I believe this moment of uncertainty is an opportunity to deliver impressive growth.

At the same time all suppliers must do the right thing to support their customers who have carried the burden of the energy price inflation of the last 2 years. Affordability and increased fuel poverty will be a legacy of the last couple of years and all Energy suppliers need to address this. With this in mind we should welcome the return of switching as a real means to save money on energy bills.

There are lots of ways in which suppliers can do right by their customers, and their business, too:

Get your strategy right

First of all, not all providers will want to grow their customer base through switching. Your strategy will largely depend on the size of your current customer base, your margins and your ability to hedge supplies. For many, it will make more sense to focus on retaining their most profitable customers – and providing them with a compelling incentive to stay instead.

By supporting customers throughout the entire lifecycle – early life, tariffs enquiries, roll-offs, home moves and all aspects of customer service – With the right customer management and retention strategies we’ve seen energy providers retain customers at much less than the cost of acquiring a new customer.

Mine your data for customer insights

Data, Analytics, and Insight can help providers understand the needs and behaviours of their existing customers, their priorities, and the situations they find themselves in – as well as the profitability of each segment to your business. (This will be especially important for the suppliers who have seen their customer bases topped up through the supplier of last resort process over the last 2 years. They will need to protect their market share whilst finding ways to stay profitable.)

By applying analytics insights to new customers, you’ll be better able to predict their lifetime value. But crucially, you can also give your advisors a massive advantage by supplying them with insights that help them have better, more successful sales and retention conversations.

Get ready to respond

As mentioned above, it’s hard to predict when and how customers are going to respond to the change in the market prices. So it’ll be important for energy providers’ CX organisations to be ready for a potential surge in customer enquiries – and gain the ability to scale operations up quickly. Especially when you don’t know where and when that demand will come in, it makes sense to work with a partner – like Firstsource – that can bring the flexibility, agility and speed to your operation. We have a distributed operating model that helps us tap into a large pool of agent resources working from home. During the early days of the pandemic, for instance, we worked with a large energy supplier and helped them proactively call up vulnerable customers and switch them to a better tariff. We still work with them today, are fully integrated into their operations and work with the same tools and CRM, to the same performance goals.

And finally: an empathetic approach

People often forget what exactly you said, but they will remember how you made them feel. So, during a time when many are still struggling to pay their bills, it’ll be more important than ever that energy providers approach vulnerable customers with empathy and demonstrate understanding of their situation. Digital debt collections can be a great way of doing that. Instead of traditional debt management approaches, a better way of engaging people with affordability challenges is often online. Letting them set up their own schemes and pay what they can when they can – sometimes a bit more, sometimes a bit less – gives them agency, and can be much more successful than outbound calls and letters.

As we’re approaching the end of June, it’s clear that the energy market is in for a few surprises. But as I see it, the potential for switching to return can also be a unique moment for the industry to step outside its comfort zone and approach its customers in fresh and unexpected ways. And if you’re keen to hear our thoughts on the right people, processes and technology to meet your customers, I’d love to hear from you: paul.collings@firstsouce.com.

Fig 1 – Electricity price trend (ofgem.co.uk)

Fig 2 – Gas price trend (ofgem.co.uk)