Drive smart, empathetic debt collections

Digital debt collection solutions focused on customer experience and convenience

Combine automation and analytics with the human touch to reimagine debt-recovery

Helping customers facing financial hardship has always been our primary focus. We blend the human touch with automation, Machine Learning (ML) and analytics to build an empathetic and efficient digital debt collection process, boosting compliance, customer satisfaction and recovery. Our data-driven digital debt collection approach helps you better understand borrowers’ financial needs and deliver customized solutions, enabling them to manage their debt smartly and lead a fuller life.

Our digital debt collections offerings span multiple industries, including Banking, Auto Financing, Education, Insurance, Utility and Telco.

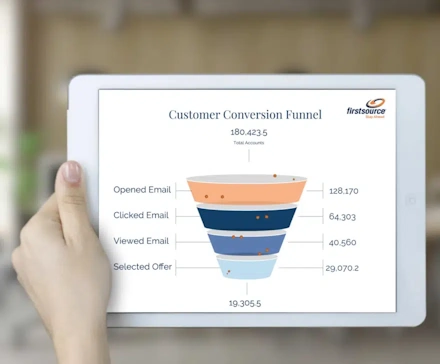

Automation & analytics

Leverage our proprietary Robotic Process Automation (RPA) based workflow, coupled with AI, ML and advanced analytics, to improve reporting, compliance and performance.

Tools & solutions

Put our suite of proprietary tools and methodologies to work to ensure data accuracy, prioritize debt collection efforts and ensure success.

Our debt recovery and collection solutions

- Empathetic and contextualized interactions tailored to individual financial situation

- Interactions on a channel and at a time of choice

- Control over debt repayment options

- Customer journey insights to tailor communications and collections

- Offer best-fit solution to customers at the right time and on the right channel

- Compliance with evolving regulatory mandates

Automation + AI/ML + advanced analytics + human touch

- Understand customer voice and drive empathetic collections

- Superior compliance and brand protection

- Industry-specific solutions across BFSI, Education and Auto-financing

Top-notch legal network management capabilities

- Gain access to a nationwide network of legal specialists

- Navigate the more complex legal collections process

- Achieve stronger returns across the ARM lifecycle

– from Pre-Suit to Post-Judgement.

Industry solutions

Banking & Financial Services

A volatile economic environment along with evolving customer expectations pose significant challenges to the debt collections process. Our digital debt recovery solutions prioritize your customers, driving best-in-class compliance and recovery.

Auto Financing

Growing auto loan defaults against a backdrop of evolving regulatory demands and customer expectations pose major headwinds to debt collections success. Utilize an optimal combination of people, technologies, best practices and tools to improve digital debt collections.

Credit Cards

Credit card debt collection presents unique challenges in the post-pandemic world. Our professional and compassionate counseling and debt collection services give borrowers complete control over their finances while ensuring effective debt recovery and compliance.