Partner with Sourcepoint for end-to-end mortgage business process outsourcing

The post-COVID mortgage market poses significant challenges to lenders and servicers – from navigating continued uncertainty to meeting evolving borrower and regulatory requirements. Adaptability combined with flexibility and scalability are key to success in the next normal.

Our digitally enabled mortgage BPO services help leading financial institutions and mortgage companies in the UK and the US accelerate cycle time, minimize risk and enhance compliance across the mortgage value chain. Spanning Origination, Underwriting, Title, Post-closing, Servicing and Collections, the solutions blend emerging technologies such as Robotic Process Automation and Machine Learning with the human touch to elevate the borrower experience.

10 Million+

Mortgage loan underwriting decisions per year100,000+

Borrower contacts per year5 of Top 10

US mortgage lenders servicedLargest UK

Mortgage lenders servicedWe at [Bank], and I personally, genuinely appreciate the consistently superior service that we receive from Sourcepoint. Among other things, it is the ability of the team to coordinate requests like these that undoubtedly makes Sourcepoint one of our very best vendors.

Stay Ahead with Firstsource

Expertly crafted mortgage process outsourcing solutions spanning the mortgage lifecycle

- End-to-end Loan Fulfilment

- Omnichannel Customer Contact

- Title & Settlement

- Post-close Document Services

- Customer Experience Analytics

- Global Call Center and Collections

- Lien Release & Assignment

- Counterparty Due Diligence

- Specialized Reverse Services

- Intelligent Automation

25+years delivering market-leading mortgage BPO solutions

End-to-end & component mortgage solutions

Customer centric solutions anchored by our ‘Digital First, Digital Now’ approach

Omnichannel customer contact and analytics

Right shore delivery – onshore, offshore or hybrid

Firstsource Academy – real time associate access to relevant digital learning products in the mortgage domain

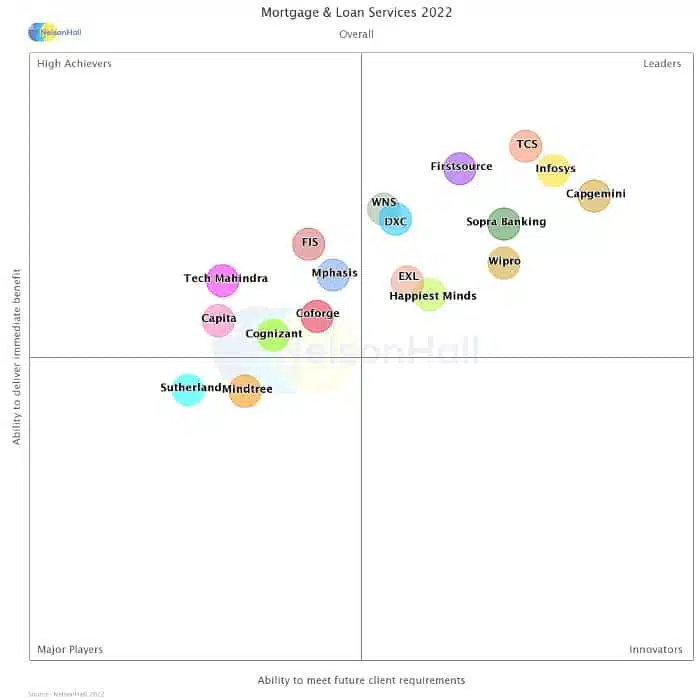

Firstsource named ‘Leader’ in NelsonHall’s NEAT Mortgage and Loan Services 2022 report for Overall Market Segment

“Firstsource is positioned as a Leader within mortgage and loan services based on the company’s strong domain expertise in lending, including in portfolio due diligence and post-closing services. Firstsource has a large partner network for legal collections and relevant licenses across originations, servicing, title, and default management, which enables it to customize and optimize delivery at a local level for the most complex and expensive of mortgage processes.”

– Andy Efstathiou, Banking Sourcing Research Director at NelsonHall.

Mortgage companies are under pressure on multiple fronts – from tackling increasing loan volumes to growing consumer expectations for rapid, personalized support. Meeting these requirements demands flexible, agile, scalable operations – one that reimagines processes from front-end customer experiences to back-end operations.

But getting started on Intelligent Automation can be daunting. What business objectives are best served through automation? What are the best-fit technologies? How to quantify benefits?