A quick guide on best practices in debt recovery with automated solutions

Why is everyone talking about Digital Debt Collection services?

The US financial landscape has changed massively in recent years with the consumer debt surpassing $17 trillion by mid-2023 and reaching $17.94 trillion in Q3 2024, according to the latest report from the New York Fed. This has raised alarm for the lending industry, highlighting the need for smart, modern solutions to handle this growing challenge.

Current debt landscape

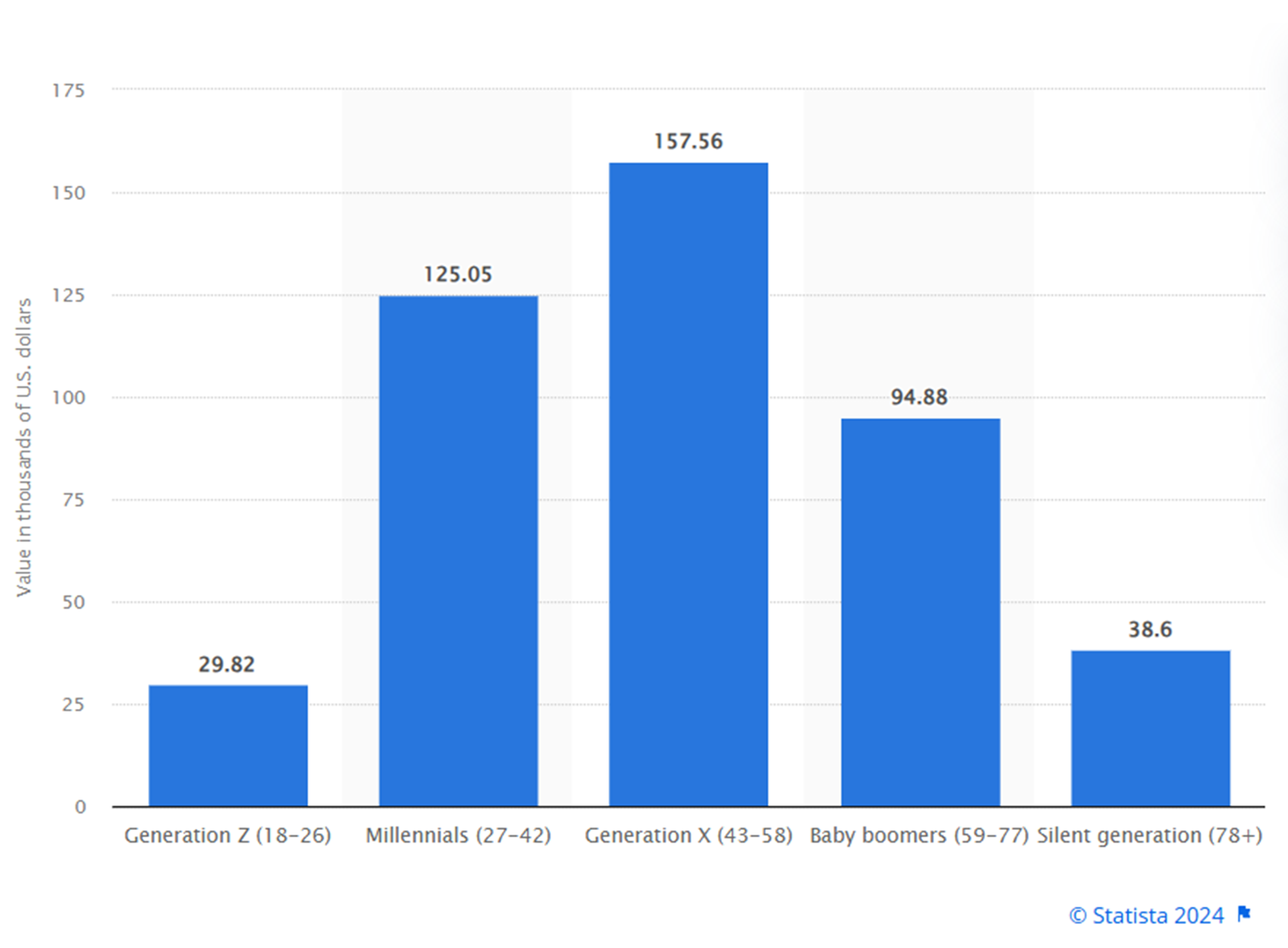

Recent data regarding generational debt distribution reveals concerning trends for the economy:

Total average debt in the United States in 2023, by generation (in 1,000 U.S. dollars)

| Generation | Average Total Debt | Median Retirement Savings |

|---|---|---|

| Gen Z (18-26) | $29,820 | N/A |

| Millennials (27-42) | $125,050 | $49,000 |

| Gen X (43-58) | $157,560 | $82,000 |

| Baby Boomers (59-77) | $94,880 | $289,000 |

| Silent Generation (78+) | $38,600 | - |

Generational Debt Overview

Source: Statista 2024 and 23rd Annual Transamerica Retirement Survey of Workers

Generation X (ages 43-58) carries the highest average debt at $157,560, followed by Millennials (ages 27-42) at $125,050. Despite being earlier in their financial journey, Generation Z (ages 18-26) already holds an average debt of $29,820. Baby Boomers (ages 59-77) maintain $94,880 in debt, while the Silent Generation (78+) carries $38,600.

As per credit agency TransUnion, Gen Z consumers are carrying higher debt levels today than Millennials did at the same age during the Great Recession of 2009, with average credit card balances reaching $2,834 in 2023—26% higher than Millennials’ balances in 2013 (adjusted for inflation).

Traditional Receivables Management models are like the Hare in the Tortoise and Hare fable – starting fast, focusing on aggressive calling, and pushing for quick customer responses. But, as Aesop’s fable shows, faster is NOT always better.

Millennials and Gen Z consumers prefer communicating with financial service providers through text messaging, E-mail, & IVR payments preferring self-service digital channels. They do not appreciate or respond to intrusive collections phone calls—a channel approach further complicated by stricter regulatory compliance

By strengthening collections capabilities and embracing Digital Debt Collection services, can help lending firms better handle any further increase in delinquencies that might occur with traditional Debt Collection.

How can Digital Debt Collection drive success?

A digitally enabled debt collection strategy can not only enable compliance and address changing customer demands but also contextualize and optimize customer interactions. Some of the major benefits of deploying a Digital Debt Collection solution to drive success include the ability to drive superior customer experience, compliance, and business outcomes such as higher collection liquidation rates and reduced cost of collection.

eBook

How digitalizing debt collection can transform results for lenders

Keys to success

Success in debt collection comes down to focusing on customers, staying compliant, and using insights to drive better outcomes.

- Customer-Centric Collections

Identifying customer needs and preferences to optimize collection efforts using the best possible channels with an omnichannel approach - Regulatory compliance management

Creating compliant communication designed to meet requirements of debt collection laws and regulations - Insight-filled solutions for customer retention

A 360-degree view of customer’s behavior through a single dashboard helps push relevant repayment options, recommend plans, and streamline communications for improved customer retention.

How Intelligent Automation improves your debt collections

By harnessing the powers of Artificial Intelligence (AI), Machine Learning (ML), analytics, and automation in debt collections, creditors and customers can reap rewards alike. Here are the top ways automation helps reduce debt avoidance:

- Using data and analytics for proactive risk mitigation Data Analytics is the key to identifying trends, anomalies, and opportunities to identify potential instances of default. Traditional debt collection companies rely on human instinct, instead of using logical sequential data to develop insight-led solutions. AI / ML can identify early potential defaulters using predictive modeling to alert collectors to proactively reach out to at-risk customers and offer credit counseling support, restructured payment plans, etc.

- Applying behavioral science to personalize the experience AI-powered tools use insights on demographic & socio-economic data to accurately predict the most effective collection methods for each customer. By tweaking debt collection strategies based on salary, profession, and historical interactions of a customer, they are able to reduce avoidance and enhance overall collection productivity.

- Focusing on customer centricity to provide enhanced debt repayment experience

Automated systems track customer preferences for contact channels, timing, tone, and repayment cadence. Driving smart dialogue between businesses and customers via Email, SMS, or WhatsApp to reach exactly where the customer visits several times a day. Empowering customers to choose solutions aligned with their needs enhances the sense of control and convenience, leading to improved repayment rates. - Enhancing communications and operations through automation

Automated outbound communication and live chatbots ensure timely, effective customer responses and help eliminate error-prone manual administrative tasks. It also improves productivity by freeing up human resources to focus on complex cases requiring personalized attention. Intelligent automation drives operational efficiency and productivity gains. - Future-proofing Legal Collections

Automation of debt collection procedures helps limit liabilities under the Fair Debt Collection Practices Act, Telephone Consumer Protection Act, GDPR, and numerous other applicable regulations. Amid an ever-tightening regulatory landscape, it can significantly help FinTechs and other organizations manage compliance risks on a national level and ensure adherence to evolving legal requirements.

How does it support your Customer Lifecycle Management

A winning Debt Collection strategy is one that leverages extreme automation across the customer lifecycle.

Acquisition

Leverage AI-driven systems to help Financial Services Providers define accurate buyer personas, score, and qualify leads based on Propensity-to-Pay models built using AI & predictive analytics.

Conversion

Marketing automation helps measure conversion rates using a combination of email engagement metrics and the collection liquidation rates (total cash collected vs total value placed) with the desired outcome of a fulfilled payment.

Retention

A unified customer view improves the ability to readily access historical information and help customers devise their own repayment model placing the power in their hands which increases long-term engagement with the borrower and retains brand loyalty.

How to evaluate your Digital Debt Collection services partner

A methodical approach should be applied to evaluate the operations partner in 3 significant areas as a duly selected partner could be the defining factor in your Digital Debt Collection strategy.

Skill Sets

With technology in the ever-evolving space, your digital debt collection outsourced partners need to build and reskill their talent base in a way that prioritizes new-age solutions consistently driven by analytics.

Integration & Cloud Expert

You must check if your partner can integrate their platform seamlessly into your existing systems without disrupting regular operations. The right partner will offer in-depth cloud solutions to accelerate business workflows, ascertain business continuity, and provide increased security.

AI-powered CX Provider

The right partner should be able to leverage sophisticated bots using Artificial Intelligence and Natural Language Processing systems to define the right debt collection strategy for customers, mitigate loss, and draw up an efficient financial recovery strategy.

How can Firstsource help you

Firstsource’s Digital Debt Collections platform is underpinned by our ‘Digital First, Digital Now’ approach that leverages diverse technologies including automation, AI/ML, and cloud-based services through a people and technology transformation framework for decoding your customer interactions and personas, reducing your cost of collections to as low as 3% and delivering better recovery rates for you.

Our debt recovery outsourcing solutions enable your customers the flexibility to choose where, when and how they manage their debt. With the ability to configure bespoke journeys, provide flexible repayment options and enable customers to adapt their plan to suit their changing circumstances, our receivables management service ensures your customers are happier.

Get a Free Demo of Firstsource’s Digital Debt Collection Platform to realize the real potential of debt collection process automation and reduce your cost of collections to as low as 3%.

How digitizing debt collections can transform results for lenders

Reference: