Adding generative AI and other AI tools to coding and chart review practices streamlines a complex process and reduces risk

Healthcare organizations are quickly flocking to AI to solve real business challenges. A survey by Deloitte reveals that 75% of leading healthcare companies are already experimenting with generative AI or attempting to scale it across the enterprise; 82% currently have or plan to implement governance and oversight structures for generative AI.

The collaborative approach of both NLP and traditional AI is pivotal in achieving a comprehensive output for risk adjustment process. By harnessing NLP, crucial data and insights can be extracted from both structured and unstructured data—like that in physician notes and summaries. AI tools facilitates in efficient identification of patterns and trends, such as those that indicate a potential at-risk patient cohort.

In short, health plans can use all these AI capabilities along with GenAI to meet the increasingly stringent data standards of the Medicare Advantage (MA) risk adjustment process.

Preparing for more rigorous audits

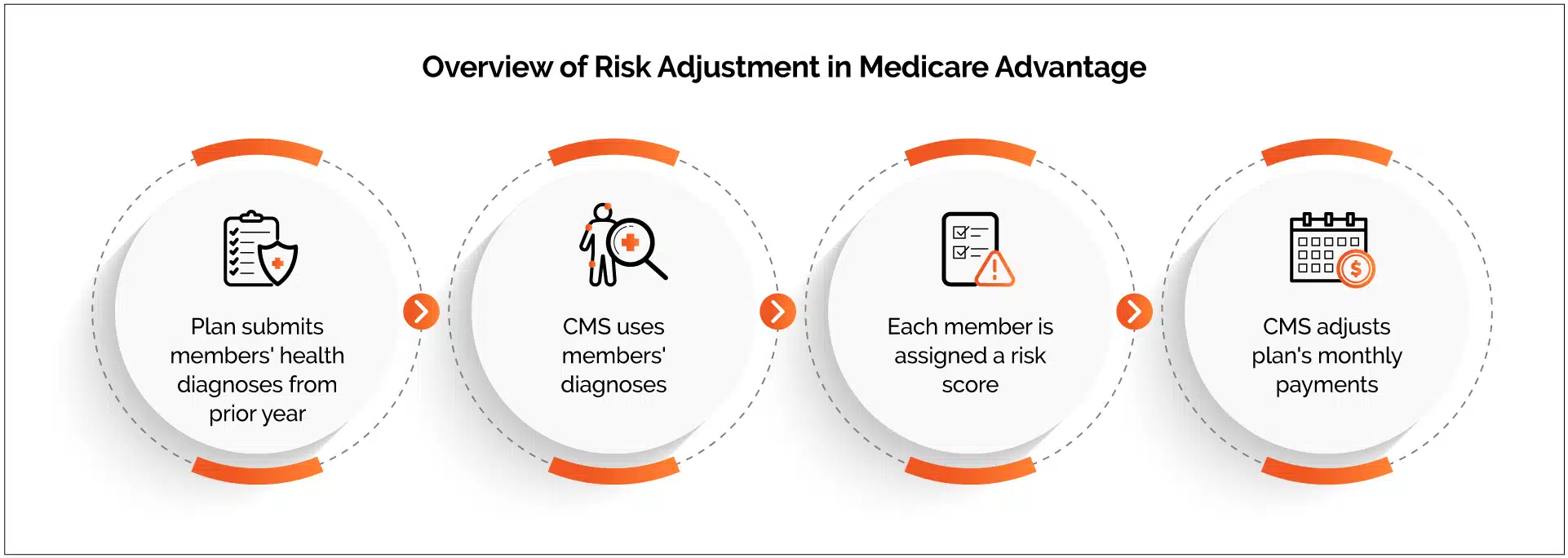

The Centers for Medicare & Medicaid Services (CMS) allocate monthly payments to MA organizations based on a risk adjustment framework that considers individual beneficiaries’ health conditions. CMS entrusts MA organizations to collect and submit diagnosis codes from their healthcare providers. This process is integral for evaluating the health status of the MA organization’s membership and establishing accurate payment amounts.

However, audits conducted by the US Department of Health and Human Services Office of Inspector General indicated CMS made $40 billion in overpayments to MA plans from 2013 through 2016 based on plan-submitted diagnoses not supported by beneficiaries’ medical records.

Responding to these findings, CMS introduced a new final rule in 2023, significantly revamping the approach to risk adjustment data validation (RADV). This involves scrutinizing claims data from a sample of plans against patients’ medical records to ensure alignment. The primary objective of this rule is to tighten oversight and mitigate overpayments to MA plans.

With the 2023 rule and tightened audits, health plans must be more proactive and ensure their risk adjustment data and practices are compliant. It is a delicate balancing act: Incorrectly reported data or unsupported diagnoses may result in failed audits, repayment requests from CMS, and potential legal consequences. Yet missed diagnoses also could lead to inaccurate member risk scores with an adverse impact on MA plan reimbursements.

AI tools, including generative AI and NLP, can greatly improve data accuracy and collection for MA plans. Used in tandem, these tools can improve coding accuracy, find diagnostic information in unstructured data and help ensure positive outcomes from risk adjustment validation.

Applying AI tools to risk adjustment

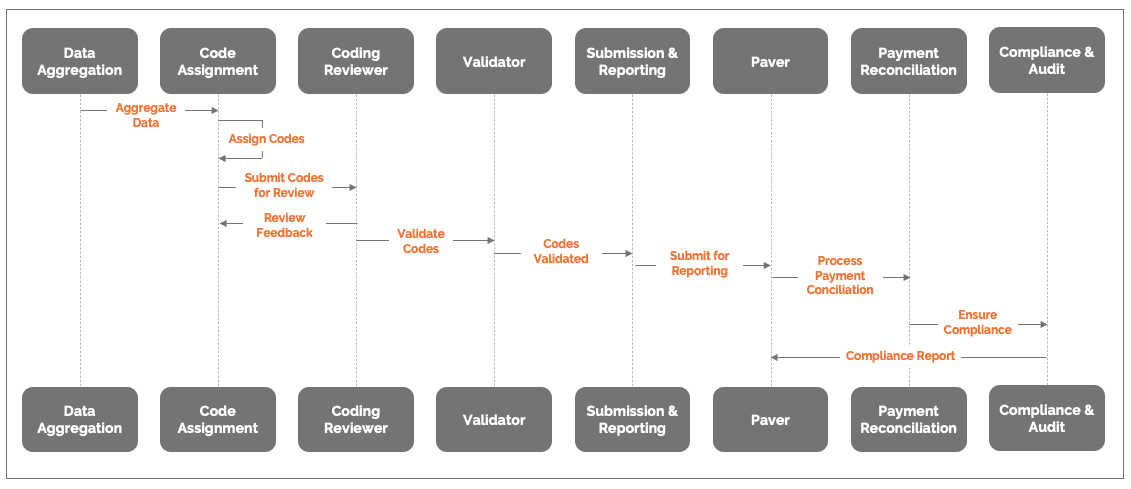

The traditional process flow for MAO risk adjustment is a laborious, error-prone journey. Documents are manually reviewed and coded, leaving ample room for inconsistencies and missed opportunities. The value chain suffers, with inaccurate data potentially leading to financial penalties, audit failures, and reputational damage. The diagram below shows the value chain of risk adjustment and the details of each process at a high level.

Risk Adjustment Process Flow

Generative AI, NLP and other AI tools can automate and streamline data collection, aggregation and analysis at each step of the risk adjustment process. Here are some the key interventions health plans can make in their risk adjustment process using AI tools:

Automated Identification and Extraction: Gen AI can identify and highlight the most relevant features — demographic information, medical history, and diagnosis codes — from a large pool of data, thus streamlining the identification and extraction process by focusing on key variables.

Data Quality Enhancement: Retrieval-augmented generation (RAG) enhances the efficiency and accuracy of generative AI models. Integrating RAG with healthcare data sources such as HL7, ICD, CPT, claims data, member demographics and more ensure data integrity and compatibility. RAG helps detect errors, inconsistencies and outliers in the data through built-in validation checks. It can even suggest corrective actions or automate cleaning procedures to improve data quality. For example, risk adjustment data analytics inputs generated by combining claims, encounters, MMR, MAO, lab and pharmacy claims help enhance accuracy and eliminate duplicates during encounter submissions.

Intelligent Code Suggestions: Generative AI can automatically suggest the most appropriate ICD-10-CM diagnosis codes and procedural codes for each member based on their clinical history, demographic data and other relevant factors. This automated knowledge synthesis enables more efficient risk adjustment processes across the whole population, with no limit to the data volumes that can be consumed.

Accuracy Augmentation: AI identifies and flag potential coding errors or inconsistencies based on coding guidelines issued by CMS, guiding coders to ensure comprehensive and precise code assignment, which helps prevent incorrect risk scores. Misleading risk scores may lead to penalties for undercoding and/or overcoding. Plans can share error findings with providers and coders so they can improve and avoid future errors.

Query Prioritization: Gen AI can analyze incoming queries from medical coders and reviewers and prioritize those with higher likelihoods of validity, streamlining the review process and focusing attention on critical issues. This enhances smart auditing by coders and auditors, instead of the traditional approach of random selection.

Automated Response Generation: Gen AI can analyze clinical documentation and identify potential gaps, ambiguities or inconsistencies in the information. It can then automatically generate queries for clarification from healthcare providers. This process helps proactively address coding uncertainties, ensuring that final codes accurately reflect the patient’s health status.

Feature Engineering: NLP uncover hidden patterns and relationships within provider notes and medical records. These insights enables health plans to identify significant risk factors and develop more accurate predictive models that consider historic, clinical and administrative data for the managed population. and further help educate providers on uncovering hidden conditions during patient assessments. Plans can use the same insights in digital engagement and surveys with members to get a better view of members’ health conditions.

Algorithm Optimization: Gen AI can generate counterfactual scenarios and simulate different payment scenarios to fine-tune model parameters and algorithms to enhance risk prediction accuracy, leading to more precise capitation payments and resource allocation. For example, generative AI can identify codes across documents, especially where HCC codes could be a combination of multiple diagnoses, such as reporting diabetes with neuropathy vs reporting diabetes only. The RAF is significantly different for the two codes.

Dynamic Risk Assessment: AI analyzes data in real time, allowing for dynamic adjustments to risk scores based on evolving health conditions. This flexibility enhances the timeliness and accuracy of risk adjustment.

Anomaly detection and Audit Preparation: AI is leveraged to conduct risk score audits that transcend typical RADV audits by comparing documented medical conditions in members’ medical records with those reflected in claims and encounter data. This analysis reduces coding discrepancies and aids in calculating financial impact. It also enables automatic generation of comprehensive financial reports and predicted AR with an “always-audit-ready system.”

Audit-Ready Risk Adjustment Operations: Way Forward

With CMS audits getting more stringent, it is critical for health plans to focus on quality and accuracy of submissions. By implementing AI tools, including generative AI, NLP and machine learning, health plans can build greater accuracy, efficiency and compliance into their day-to-day operations. That way, plans benefit continually from more streamlined operations while also helping ensure they are ready at any time for an MA risk adjustment audit.

For more information on how Firstsource can help you navigate risk adjustment with innovative solutions, please contact Priyanka Grover, AVP – Firstsource Health Plans and Healthcare Services; Nikita Agrawal, Firstsource Health Plans and Healthcare Services; and Anushka Saxena, Firstsource Health Plans and Healthcare Services.