The challenge: Reducing operating costs without jeopardizing growth

The client is a leading international payments and foreign exchange provider based in the UK, serving corporations, financial institutions, and individuals globally.

Driven by strong performance in international payments for corporate customers, the FinTech’s business grew rapidly in just a few years. It decided to add more resources to scale its operations and keep pace with the accelerated growth.

However, as most of the processes were manual, this approach resulted in a linear increase in operational costs. What’s more, fragmented operations across multiple teams led to major inefficiencies.

The client’s C-suite – including their COO, CTO, CFO and Head of Risk & Compliance – realized they needed to rein in the runaway costs. They chose to partner with Firstsource for its ‘skin in the game’ approach — setting realistic ROI targets and taking complete ownership over identifying and implementing automation opportunities aimed at improving customer acquisition and onboarding.

The solution: Automation solutions and operating model redesign

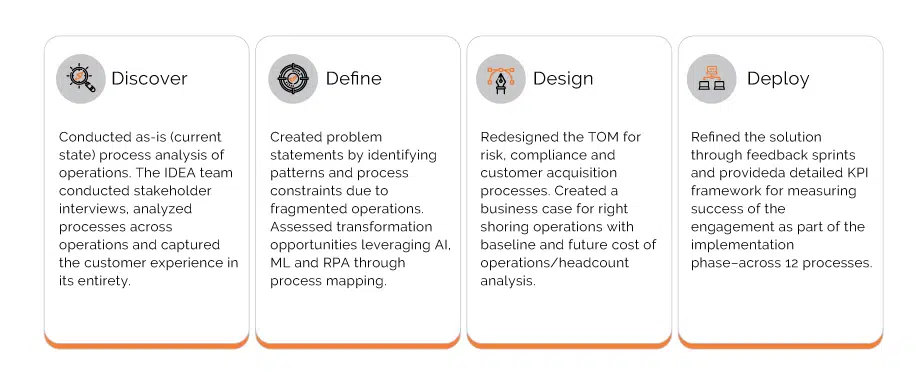

Our Insights, Design Experience and Advisory (IDEA) services team adopted an agile approach to designing and implementing the target operating model (TOM).

First, we broke down 12 key processes into smaller sprints of two processes each. We then took a phased approach to each sprint – Phase 1 spanning an eight-week consulting engagement to identify key transformation initiatives, which will be followed by Phase 2 spanning a three-to-six-month period for designing and implementing the solution.

Our team embraced a four-step methodology – from identifying the opportunity to mapping the strategy to designing and implementing the solution (see Figure 1).

Figure 1: A structured approach for delivering measurable results

The result: Agile processes cut costs and elevate the customer experience

Digitally enabled processes resulted in high-impact outcomes for the FinTech, including enhanced efficiency and productivity. Our automation and RPA-based solutions helped drive:

- 40-70% reduction in client acquisition costs (depending on the scenario preference)

- 55% reduction in corporate account onboarding time

- $3M of direct cost savings across client acquisition and risk & compliance processes

- 15% reduction in 3rd party commission payables.

The client is thrilled with the striking outcomes we’ve delivered to date and is currently working with us to harness other automation opportunities identified during the consulting stage.