It’s 2024, and digital-first is quickly becoming the only approach. Consumer preference for digital banking is on the rise: 71% of consumers prefer it. This represents a larger trend where consumer expectations for services have evolved. Seamless, real-time, digital interactions are the baseline. The logical next step for any company that collects consumer debt is to start engaging collections customers where they expect it: digitally.

In my view, there’s no time to waste. U.S. household debt is at a record high of $17.79 trillion, while credit card delinquency has reached levels not seen since the 2008 financial crisis. This makes digitization an urgent challenge for collectors – yet I’m seeing hesitation from companies that should be diving in because they don’t see a clear path forward.

Research from McKinsey shows consumers prefer digital outreach, even in the later stages of delinquency. 73% of customers in late delinquency made a payment when contacted through digital channels. Still, the majority of collectors use traditional outreach with much lower response rates. Collections teams need a clear path forward. So, I’ve collected best practices on digital collections from industry leaders. Using these best practices in partnership with my team can lead to big results, like a revenue lift of 16% and a significant reduction in cost-to-collect for one recent client.

Below is a breakdown of the biggest challenges and benefits of digital collections. I’m exploring the urgent call for a better customer experience and sharing strategies for building a digital-first approach the right way.

Why is the traditional collection approach a costly choice?

Traditional debt collection methods are increasingly ineffective, both in terms of engagement and costs. Companies wedded to old-school methods, like phone calls and snail mail, need expensive manual labor and more personnel.

Add in the customer experience, and it’s clear that traditional methods don’t make sense. Debt is a huge source of stress and comes with feelings of anxiety and shame, according to the American Psychological Association. That anxiety only increases when the phone doesn’t stop ringing.

My team’s research at Firstsource has brought back some notable data about customer experience with traditional methods:

- Debt collection calls have a 2-3% success rate.

- 90% of calls from an unrecognized number go unanswered.

- It takes an average of 15 calls from an unknown number before the recipient answers.

Even if a call is picked up, most responses are: stop calling. By that point, an employee has invested a lot of their time, often for no result.

Digital communications, on the other hand, can have open rates of 50% or greater. Engaging consumers digitally allows them to be in control of the interaction. They’re empowered to manage their debt on their own terms and timeline while maintaining their dignity.

How can you transform the customer experience?

Customers are the heart of your business, so why not build processes driven by empathy towards their journey? I’ve seen how compassionate collections transform customer relationships. An empowered customer is a returning customer.

Digital debt collection methods reach more consumers and provide a positive customer experience while allowing companies to offer personalized touchpoints and payment plans. A digital-first approach frees up staff time to focus on professional, consistent, and personalized communications. Reducing operational costs, increasing customer engagement, recovering more debt, and receiving fewer customer complaints are hallmark improvements I’ve seen at companies and institutions that enact digital collections strategies.

The benefits are clear – and there’s no shortage of ways to launch a digital collections initiative.

What to do first: key strategies for digital collection

No matter what drove your team to digital collections—meeting consumer expectations, increasing debt return, improving customer experience, or cutting costs—getting started can feel like facing Everest. How do you climb Everest? One step at a time.

As you build your digital collection program, use these proven strategies that have worked for our clients:

1. Embrace a hyper-personalized, digital-first approach.

One size doesn’t fit all. A digital-first approach doesn’t just mean emails and texts. A hyper-personalized approach is key for all stages of delinquency, from billing alerts via app pop-ups to live chats with past-due customers. Don’t limit yourself to one form of communication, where notifications are easy to miss or ignore.

2. Offer self-service payments

Self-service capabilities are key, so customers can take action by themselves at a time and place that works for them. At Firstsource, we’ve found that 92% of customers use self-service payments when available. This not only improves collection results but also increases customer satisfaction and retention.

3. Use the right CRM and billing systems

The tech and tactics that organizations use for collections can impact a digital collection strategy’s success. The right systems provide the data you need to determine when a consumer should be referred to collections. Analyze payment history and categorize customers based on risk factors to catch potential delinquencies before they happen and put customers into the right communication workflow.

How to do it: navigating the road to implementation

If your team is bought in on digital collections, a few challenges should be top of mind. If you’re not prepared, these can trip up even the best-laid plans. At Firstsource, our experience means we’re prepared to steer our clients through every single challenge.

1. Long implementation timelines

Transitioning to digital debt collection doesn’t happen overnight. Implementation timelines can be 6 to 8 weeks, thanks to:

- Complex integrations of new digital platforms with legacy systems

- Data migration

- Extensive testing to ensure that processes are compliant

This means it’s even more important to get started right away.

2. Operational changes

The shift to digital also requires significant operational adjustments. Existing workflows must be re-engineered to incorporate digital touchpoints, while policy and procedure documentation has to reflect these changes. Companies need to update how they monitor compliance to ensure adherence to regulations, and staff must be trained on new digital tools. At Firstsource, we work with our clients so every member of the team is on the same page. Our proven playbook for smarter implementation means no steps are missed, preventing potential pitfalls and legal issues.

3. Adapting to a shifting regulatory landscape

As digital debt collection practices are widely adopted, regulations may evolve quickly. Companies should keep an eye on:

- Channel-specific rules and frequency limits, which may be distinct across email, SMS, social media, and other channels

- Consent management systems, which need to track and honor consumer preferences and opt-ins

- Data privacy, which is often more complex on digital channels because of how they collect information

Complex regulations are my team’s bread and butter. We’ve got deep regulatory expertise and audit-ready processes that help de-risk your business, even when you’re transforming the way you work.

These challenges shouldn’t deter your team from diving into digital debt collections. The numbers are clear: successful collections are digital. Being future-ready means embracing that change.

Is a seamless transition possible?

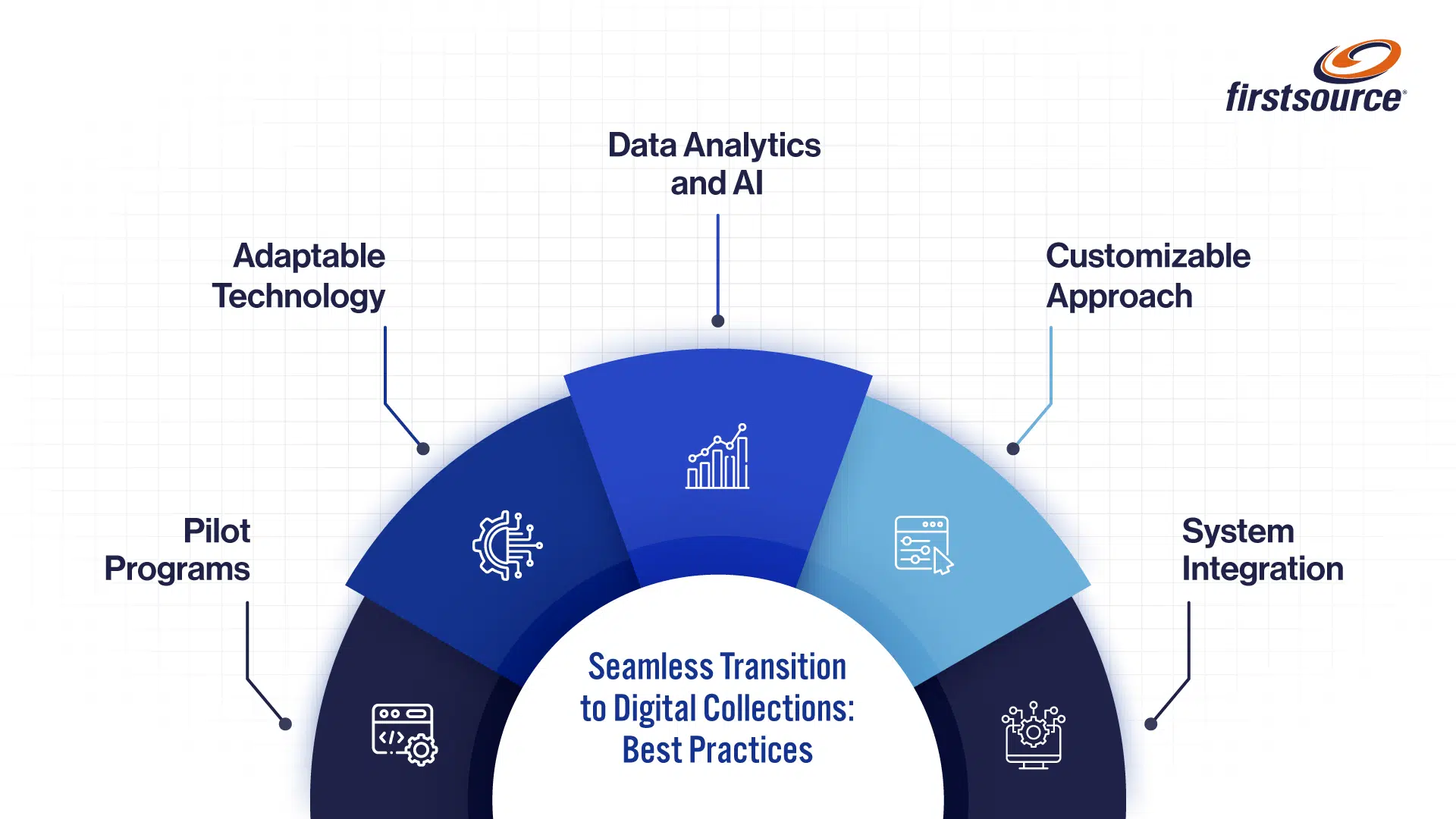

Despite the potential challenges, the transition to digital collections can be seamless with the right tools, tech, and planning. There are a few best practices that I’ve seen come up again and again with industry leaders who have successfully moved into digital.

1. Start with pilot programs to test and refine your digital strategies: Pilot programs help your team identify challenges and opportunities. Gather data on costs and resource needs, and evaluate user feedback. Refine your strategies based on lessons learned before full-scale implementation. This iteration is what Firstsource has been doing for decades: ensuring that every process and solution is tested until it meets your specific business needs.

2. Invest in adaptable technology solutions that can evolve with your needs: Opt for scalable platforms that can accommodate growth and cloud-based solutions that offer flexibility and easy updates.

3. Leverage data analytics and AI: Analytics tools can help track user engagement, while AI can quickly analyze data to inform decision-making processes and optimize collection efforts.

4. Integrate new digital channels with existing systems: Ensure new platforms and legacy systems integrate seamlessly by developing workflows that bridge traditional and digital processes.

5. Adopt a customizable approach: Though most consumers want digital collections, some prefer the traditional methods. Don’t overlook them—conduct user surveys to understand preferences, and develop hybrid services that accommodate both types of users. Dive into the data to ensure you’re striking the right balance.

Crossing the finish line: a partner that drives success

The world of debt collections is changing fast in response to consumer preferences – it’s clear that digital collection is the path forward. A company like Firstsource can offer resources that make the digital transition smooth. Firstsource recently partnered with a leading global payment provider to implement an end-to-end digital solution, and the results were conclusive:

- Immediate 16% revenue lift

- Significant reduction in cost to collect

- Increased customer satisfaction

- Better performance compared to internal solutions and long-term partner network

- 56% + 6-month liquidation rates

Our custom end-to-end solution and proprietary analytics models make these results possible for our clients. They also find:

- Industry consultants who share expert advice on digital strategies—specific to your company’s needs

- Tools and solutions for automation and app integration

- Personalization options, including 200+ email and SMS templates, built for over 7,000 customer profiles

- Data and AI expertise to refine collection strategies with the right analytic insights

- Change management support that ensures smooth transitions for the entire company

- Regulatory compliance guidance from experienced specialists

Embrace digital engagement in debt collection with Firstsource and you’ll find lower costs, operational efficiency, increased engagement, and stronger returns. Contact our team today or reach out to Tim: tim.smith@firstsource.com for personalized digital debt collection solutions. We’re ready when you are.