The challenge: Overcome inefficiencies due to manual processes

One of the US’ largest mortgage companies faced multiple challenges in its day-to-day lending operations. Predominantly manual processes led to error-prone, ad-hoc processing and segregation of loan documents. In addition, siloed legacy processes and applications resulted in poor visibility and rampant inefficiency. Multiple, unstructured formats and diverse document standards further compounded the situation leading to low efficiencies and poor cycle times. The loan origination process needed to be re-engineered to increase productivity, cut training time, improve associate utilization, and reduce cost-to-serve.

The solution: Automation backed by an outcome-driven approach

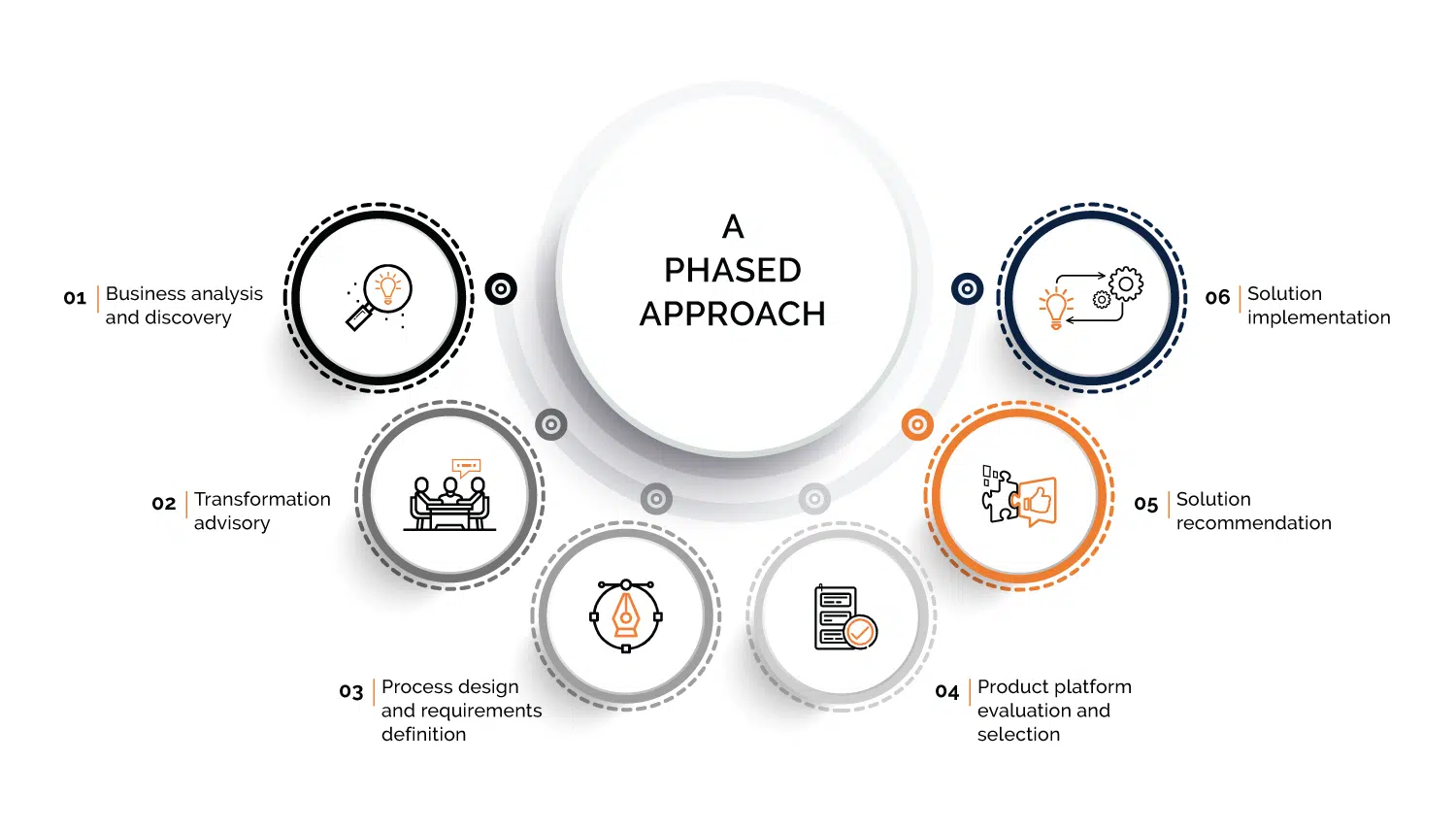

The Firstsource team leveraged its Robotic Process Automation (RPA) solution backed by its Business Outcomes Design advisory services. We automated high volume, low complexity aspects of the loan set-up process. For those that required greater human intervention but where automation was not possible, we deployed a hybrid delivery model (onshore-offshore support). Our advisory team implemented a phased automation plan with a step-by-step approach including:

- Business analysis and discovery: Set up a Center of Excellence (COE) team to understand the challenges faced by the client.

- Transformation advisory: Evaluated various options – reengineering, outsourcing, and automation – and chose to implement an automation solution to drive desired outcomes.

- Process design and requirements definition: Studied the process in-depth, created a process design document, designed an automation solution and articulated it as part of the business requirement documents, and developed detailed process maps.

- Product platform evaluation and selection: Evaluated the features and functionalities of available automation platforms in the market and performed a gap-fit analysis to select the appropriate automation platform based on the requirements.

- Solution recommendation: Encapsulated the automation solution along with the product platform recommendations for implementation and demonstrated the ROI expected to the clients. The client steering committee approved the identified automation opportunities and technologies.

- Solution implementation: Based on the roadmap and design set by the Business Outcomes Consulting team, the implementation team implemented an RPA solution that helped the client integrate multiple systems, create new interfaces with automation, and reduce process complexity.

A cross-functional team representing the client and Sourcepoint met at regular intervals to review progress and resolve issues. Calls and scrum meetings helped the client track and review progress on a day-to-day basis. We also collaborated with their tech team to leverage APIs and webhooks.

The result: Structured and standardized processes delivering higher efficiency and productivity

The project was completed in four months with the expected performance gains. The project cost analysis revealed a 30% improvement in efficiency with corresponding cost savings. By processing structured and unstructured documents seamlessly we reduced Cycle time by 20%, positioning the client to be competitive in the expanding mortgage market.

Consistent with the client’s desire to own its technology future, we helped them establish their Center of Excellence for automation, solidifying and empowering their technology positioning.