Driving innovation and transformation in mortgage services

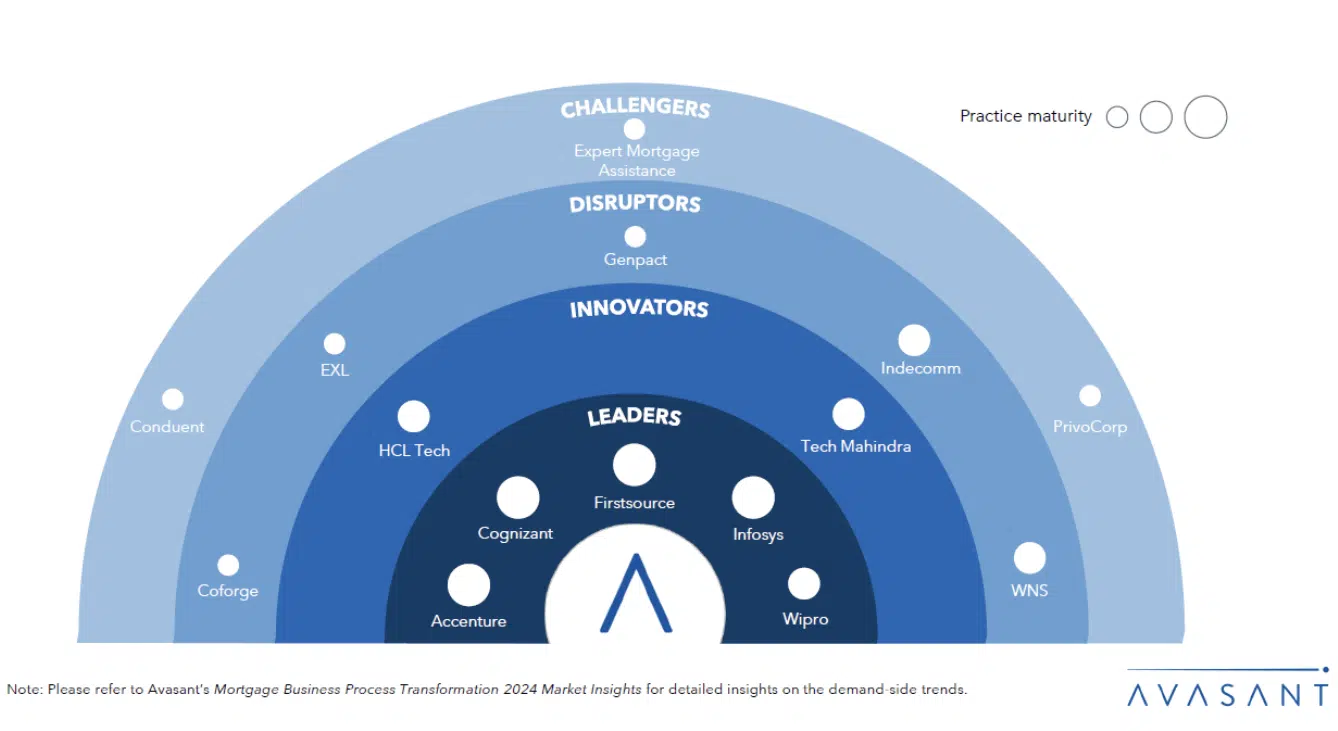

Firstsource company, has been recognized as a Leader in Avasant’s 2024 RadarView™ for Mortgage Business Process Transformation. Sourcepoint, a Firstsource company, drives our mortgage business with innovative solutions and industry expertise.

Report highlights include:

- Key trends shaping the mortgage industry, including the adoption of Generative AI for automation and predictive analytics.

- Detailed evaluations of the top 15 providers in the industry.

- In-depth analysis of what sets Sourcepoint apart as a leader.

What sets Firstsource apart as a leader?

Practice maturity

With over 25 years of experience, Firstsource, through its US-based franchise Sourcepoint, provides end-to-end mortgage process transformation services. It holds licenses across originations, collections, contact centers, and servicing. The company manages 250+ mortgage processes and serves 500+ clients globally, including major banks and mortgage lenders. Its AI-driven platforms, such as ILM for document processing and LES for loan quality control, enhance operational efficiency and support client-specific needs.

Domain ecosystem

Firstsource partners with Krista, PAL, Base64.ai, and Verint, integrating automated quality checks, AI document processing, and proprietary analytics. Collaborations with UiPath, Automation Anywhere, OpenBots, and Celonis further strengthen its automation and process mining capabilities.

Investments and innovations

Firstsource has developed a gamified e-learning ecosystem with over 30 domain-focused courses, enhancing employee participation. Its generative AI framework, FirstSense.AI (now known as relAI), includes innovations in underwriting and quality control automation. The 2021 acquisition of The StoneHill Group expanded its domain expertise and client base.