As Published In: Forbes India

Over seven years, Sanjiv Goenka has remade his group by shedding an obstinate old guard and focusing on bottomlines. Now, with a demerger imminent at CESC, the value of the flagship power business—and the newer ones—are waiting to be unlocked

Quite a few pieces of the artwork that adorn the walls of the fifth floor of CESC House (the heritage building in central Kolkata previously known as Victoria House), that serves as the RP-Sanjiv Goenka (RP-SG) Group’s headquarters, have been acquired by the conglomerate’s chairman from budding artists. How does Sanjiv Goenka, 56, know, in the absence of pedigree, which of these paintings will go on to become multi-baggers? “You can figure out from the brushstrokes,” replies Goenka, who was ranked 91 on the 2016 Forbes India Rich List with a wealth of $1.4 billion.

Like with art, Goenka isn’t afraid of taking bold bets in business either. He assumed independent control of his share of RPG Enterprises, following a division of business interests between his elder brother Harsh Goenka (currently chairman of RPG Enterprises) and himself in 2010. Ventures belonging to the undivided RPG Enterprises, founded by Goenka’s father, the late Rama Prasad Goenka, such as power generation, power distribution, retail and carbon black are now a part of the RP-SG Group. His brother, based in Mumbai, controls businesses including tyres (under the Ceat brand), engineering and software services (Zensar Technologies).

Sanjiv Goenka has since made sweeping changes in several areas of the group. His focus on operational efficiency and the constitution of a new management across group companies, where the old guard was “resisting change”, appear to be working for the RP-SG Group.

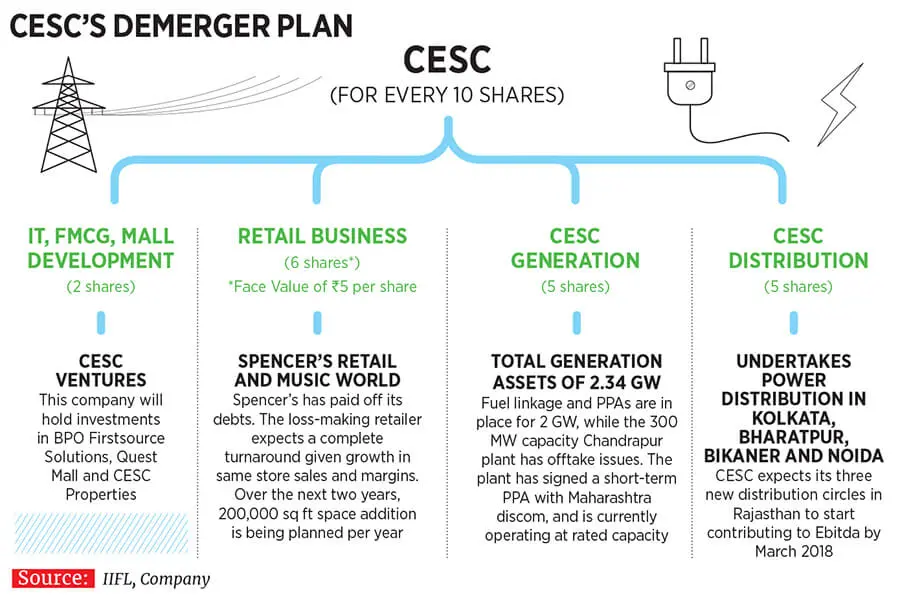

This allows Goenka to prepare to unlock the next phase of value creation through measured expansion and an elaborate restructuring. Businesses like power generation, power distribution, retail, FMCG and mall development (all currently part of group flagship CESC Ltd) will be spun off as separate listed entities (see CESC’s Demerger Plan). “Although the demerger will not lead to earnings accretion, it should lead to a significant improvement in valuation multiples for the core power business. This is because, under the [current] structure, the power business has funded diversification initiatives, which depressed valuation multiples despite CESC having one of the best operating matrices,” says a May 2017 report by domestic brokerage IIFL.

The demerger is expected to eliminate the ‘conglomerate discount’ that weighs on CESC’s current market value, by clearing the way for sector-specific investors to take positions in the companies that interest them. The IIFL report says that the combined market capitalisation of the separately-listed entities post the demerger could be 40-50 percent higher than CESC’s current market capitalisation.

The group’s plan to separately list the different businesses under CESC by October is the logical next step, since the restructuring that Goenka initiated has started bearing fruit. The balance sheet is evidence of this. Compared to five years ago, the RP-SG Group’s turnover has doubled to Rs 19,330 crore. The growth in turnover has been accompanied by a robust rise in profitability with the group’s profit before tax in the same period more than doubling to Rs 1,368 crore. The RP-SG Group’s gross asset base has also grown by over four-fold to around Rs 33,500 crore in this time frame.

“The internal yardstick that we used to look at in the past to measure performance was growth in turnover. To me, while that could have been a benchmark, it couldn’t be the benchmark,” says Goenka during his chat with Forbes India in his office that offers panoramic views of Kolkata’s landscape with the sprawling Victoria Memorial in the background. “The first thing I did was to put efficiency as a barometer to gauge our competitiveness and when I did a scan, we realised we weren’t particularly competitive. The focus now is squarely on the bottomline.”

Consequently, one of the first things Goenka did after establishing the brand identity for his conglomerate in 2011 was to hire consulting firm McKinsey & Company to identify areas where operational improvement was needed, how to achieve such improvement, and advise on the potential growth drivers for the business.

Goenka’s decision to bring in an external consultant wasn’t well-received by a section of chief executives running his group businesses. He recalls a day in 2012 when the entire senior leadership of his diverse group companies came in a collective and accused him of “behaving like an owner”. They were uneasy about Goenka and the team from McKinsey asking too many questions and finding fault with many of their earlier decisions.

“I realised then that these people will not allow change and that I needed to change them,” says Goenka candidly.

Take group company Phillips Carbon Black (PCBL) for instance. Despite being the largest supplier of carbon black (a raw material used in manufacturing tyres and paint) in India, and one of the largest in the world, the company was struggling with low profitability and even incurred losses in FY13 and FY14. “From logistics to fuel and raw material procurement, almost every function in PCBL needed to be overhauled,” recalls Goenka.

Goenka then brought on board a new professional to helm operations at the beleaguered company. Kaushik Roy, a veteran of two decades at Apollo Tyres and a former member of its management board, joined PCBL in 2013 as Goenka’s change agent.

Transformational steps taken by Roy included changing the company’s stance from looking at India as its primary market to selling anywhere in the world where the best price could be fetched. The proportion of specialty carbon black (a value added product with high margins) in the overall product mix was increased; and an overdependence on the US for raw material procurement, which entailed a longer lead time and higher risk of inventory losses due to fluctuating prices, was curtailed by developing Singapore, South Korea and India as sourcing hubs.

As its head since 2013, Shashwat Goenka has revived the fortunes of Spencer’s Retail. The result was a gradual improvement in PCBL’s profitability starting in FY15. Compared with a net loss of Rs 88 crore in FY14, the company posted a net profit of Rs 68 crore in FY17, on a total operating turnover of Rs 1,946 crore. “The company always had the inherent strength to do well. Perhaps it got complacent and didn’t notice China’s emergence as a dominant player in the carbon black market,” says Roy.

RK Jha, the RP-SG Group’s chief financial officer, is a veteran of 45 years at the conglomerate, who has enjoyed the confidence of three generations of Goenkas—RP Goenka, his son Sanjiv and grandson Shashwat. Jha says Sanjiv gets involved more deeply with the intricate details of individual businesses than his father did.

Rabi Chowdhury, who will take over as the managing director of CESC’s soon-to-be-listed power generation business, confirms Goenka’s obsession with operational excellence and his hands-on approach. “It isn’t uncommon for us to get a call from the chairman inquiring about technical aspects like heat rate, oil consumption and auxiliary power consumption rate,” says Chowdhury. “He also expresses his displeasure if these operating metrics don’t match up to the benchmark.”

Chowdhury adds that through prudent project planning, CESC’s power plants such as those at Haldia and Budge Budge in West Bengal have been running at a healthy plant load factor. CESC has, however, faced stress at its thermal power plant in Chandrapur, where it has still not been able to sign a power purchase agreement with the Maharashtra government. The project, which reported a loss of Rs 500 crore in FY17, is supplying some amount of power for the short term to Maharashtra and Tamil Nadu state electricity distribution companies, and is supplying power through a contract to Noida Power Co, a CESC subsidiary that has the right to distribute power in Noida.

Pointing to the RP-SG Group’s prudent approach to the power sector, the managing director of a multinational financial services firm that advised CESC on the restructuring says that even when it was a “fad” for companies to build large and multiple thermal power generation projects, including ultra-mega power projects (projects that have a capacity above 4,000 MW), Goenka refused to take the plunge. “This drew criticism from analysts who said that CESC wasn’t doing the right thing to grow the business,” says the person.

The current state of surplus power capacity in the country has proved Goenka right, as many of these big-ticket projects are either stuck or idling. CESC, which was acquired by RP Goenka in 1989, has put a pause on any plans to expand power generation capacity and decided to focus on its power distribution business as a future growth driver. In addition to being the sole supplier of electricity to Kolkata, CESC also supplies power to Noida and has recently been awarded distribution rights for three cities in Rajasthan.

Once the restructuring happens, CESC’s power distribution business will be hived off from power generation. The IIFL report points out that this will lead to the power distribution business becoming India’s first pure-play listed entity of its kind, offering a unique opportunity for shareholders to own a distribution entity in India.

In the 1990s, Kolkata was notorious for frequent and long power cuts. Much has changed since then with eastern India’s largest city receiving reliable power supply with minimum disruption. Aniruddha Basu, managing director of CESC, says his company is relying on innovation and a customer-centric approach to further enhance CESC’s reputation as a power distribution company, which will also help its case when it bids for new contracts in other cities.

New connections, which earlier took a week to sanction, are now installed within 24 hours of applying. Through automation and technology-enabled network management, CESC can restore a power supply fault in two minutes on an average and within a minute at essential installations such as hospitals, it claims. Basu says that by ensuring minimum disruption, he can deploy additional resources to focus on preemptive maintenance, which creates a virtuous cycle of improving the quality of power supplied.

“In the power distribution business, there is pressure on fixed costs and tariffs can’t grow beyond a point. So the only alternative is efficiency improvement,” says Basu. “So further growth can only come through innovation and cost leadership.”

Goenka says he wants to reduce his company’s dependence on businesses that involve a high level of government intervention to grow in non-regulated, consumer-focussed spaces. This strategy entails growing the group’s retail business and entering new verticals such as consumer goods and sports.

While the RP-SG Group is testing the waters in the FMCG business, it is learning from the past mistakes of its retail venture. Spencer’s Retail, which owns and operates a chain of organised retail stores across the country, was one of the first players to bring large format retail to Indian consumers. But an aggressive strategy of expansion plunged the venture into losses.

Goenka’s son Shashwat, who segued into the group in July 2012 by working with McKinsey to learn the ropes of the businesses his family enterprise was engaged in, chose to take up the challenge of reviving Spencer’s fortunes as its head in 2013. Spencer’s Retail has since scaled down operations and closed a number of unprofitable stores.

It has trimmed the size of its hypermarkets from over 30,000 sq ft earlier to between 15,000 sq ft and 30,000 sq ft. The retail chain, which earned revenues of Rs 2,038 crore in FY17, has also decided to focus on adding nine to 15 stores a year [to its existing network of 127 stores] over the next five years in India’s northern, eastern and southern regions, while avoiding the western market. This is perhaps because western India has well-entrenched players like Hypercity and DMart, which would make it difficult for a late entrant to expand meaningfully.

“Goenka expects his group’s profitability to at least double over the next three years”

Spencer’s is also progressively increasing the proportion of non-food items—such as apparel and homeware—that it stocks at its stores, which are aiding profit margins. In FY17, Spencer’s made a store level Ebitda (earnings before interest, tax, depreciation and amortisation) of Rs 1,212 per sq ft, up by nearly 20 percent from FY16. In the last fiscal, Spencer’s recorded eight consecutive months of positive Ebitda at a company level, though it was a negative of Rs 46 crore for the full year. Shashwat says he expects his company to report its first full year of operating profits in FY18.

“Like many other players in the market, we expanded too soon and spread ourselves too thin,” says Shashwat, an alumnus of the Wharton School, University of Pennsylvania. “Everyone believed scale was the most important thing to get to profitability and in the process, economies of scale were lost somewhere.”

The RP-SG Group is also leveraging its retail experience to enter the consumer goods business, which it did in April, with the launch of its Too Yumm! brand of low-calorie snacks. Encouraged by the initial response to its products, and to rapidly gain scale, Goenka is in active discussions for two acquisitions in this space, which are likely to be announced shortly. “These are small acquisitions of local brands and their distribution network, which we can scale up,” says Goenka.

Inorganic growth has been a part of the Goenka family’s legacy, which Sanjiv Goenka is taking forward. RP Goenka was famous for his aggressive approach towards acquisitions, through which companies like CESC, PCBL and tyre maker Ceat came into his group’s fold.

Tuck-in acquisitions are also being used to bolster the capabilities of Firstsource Solutions, a business process outsourcing (BPO) company acquired by the RP-SG Group in 2012 for Rs 400 crore. In 2016, Firstsource acquired the BPO division of US-based ISGN Corp, a solutions provider for the US mortgage industry; and in 2014, Firstsource had acquired a stake in Bengaluru-based Nanobi Data and Analytics.

Since acquiring Firstsource, the RP-SG Group has been actively working towards improving the company’s financials. The firm’s Ebit (earnings before interest and tax) margins have expanded from 6.6 percent in FY13 to 10.7 percent in FY17. Over these four years, the company’s outstanding debt has also been brought down to Rs 600 crore from Rs 2,500 crore. Firstsource also won a major contract in February when it signed a 10-year deal with Sky Subscriber Services, worth Rs 14,000 crore.

Goenka also has serious aspirations in the media business. His name often does the rounds when the names of potential suitors of media businesses on the block are speculated upon. His name cropped up in 2012 before the Aditya Birla Group picked up a stake in the Aroon Purie-controlled Living Media India; and earlier this year with respect to the Kolkata-based ABP Group.

While Goenka doesn’t comment on these instances, he confirms that a sizeable acquisition in the news media space is on the cards. The RP-SG Group currently owns and runs the news magazine Open.

Sports is another area of interest for him. The group is already a co-owner of the Atlético de Kolkata football team in the Indian Super League, and was awarded the franchise for a team, Rising Pune Supergiant, in the Indian Premier League for two years (which ended this year). Goenka, who likes to watch cricket, tennis and football in his spare time, has already signalled his intent to have a sizeable portfolio of sporting properties by announcing his group’s entry into the Ultimate Table Tennis league with his team RP-SG Mavericks. Sports also serves the purpose of enhancing the RP-SG Group’s brand visibility across India.

Having invested over Rs 16,000 crore to lay the foundation of his conglomerate’s future, Goenka expects his group’s profitability to at least double over the next three years. “Growth in revenues and assets are incidental to the objective of enhancing profitability,” Goenka says.

The bold brushstrokes with which Goenka is painting the canvas that he inherited seven years ago are making for a satisfactory picture.