The challenge: Pressing need to optimize the revenue cycle

Aspen Valley Hospital (AVH), a 25-bed community hospital, caters to the healthcare needs of the local population in a remote area. With nearly 45K outpatient registrations and nearly 8K emergency visits, the hospital generates $102M in annual revenues.

Because of its remote location, AVH faced substantial challenges in recruiting and retaining skilled employees to support the growing complexity of healthcare receivables. It wasn’t so much about getting people, but rather getting the right people to work within a best practice operating model. As a cascading effect of these staffing challenges, the hospital’s business office performance declined. Claims processing slowed and filing accuracy decreased, thereby increasing payer denials dramatically. While revenue remained relatively flat year over year, cash flow dropped, billed receivables increased 13%, revenue aged greater than 151 days increased by 50%, and total receivables increased by 35%.

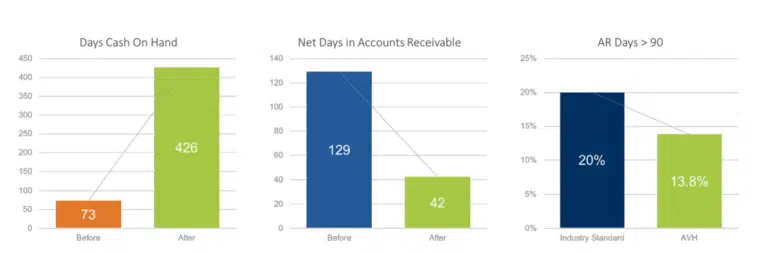

AVH management identified lack of talent and best practice-based workflow along with retention issues as the primary factors contributing to the declining financial performance. Yet, it wasn’t enough to know the problem or even how to solve it. The AVH leadership team needed to course correct at an accelerated pace. When Days-Cash-on-Hand reached 73, the leadership team raised their hands for help from outside the organization. AVH reached out to Firstsource to streamline revenue cycle management (RCM) to improve staff productivity and cash flow.

The solution: Redesigning the revenue cycle billing and collections operation for a stronger financial foundation

The hospital partnered with Firstsource to implement a comprehensive RCM solution spanning assessment, design, implementation and ongoing support leveraging Firstsource’s Hospital Business Office Management Solution.

AVH management realized that they were not best serving their community by maintaining in-house financial operations. The Firstsource team evaluated the billing and collection follow-up processes, identified opportunities to accelerate AVH cash collections, and redesigned the revenue cycle billing and collections operation. The full revenue cycle assessment helped in identifying quick fixes and long-term actions to improve outcomes.

Firstsource advised on process improvements, helped the team identify necessary resources, organized the staff, and implemented a best practice-based workflow to streamline billing and improve accuracy. Integrating key functions — from pre-registration and bill estimation to payment planning and billing — into a unified workflow, created a patient-friendly financial experience to improve collections.

We consider Firstsource as more than just a partner. We think of the Firstsource staff as our staff and part of our family.

Dave Ressler, CEO.

The result: Outperforming on all indicators

AVH realized significant benefits within 12 months. Cash on hand increased from 73 days to 426 days (+583%). Net days in accounts receivable reduced from 129 to 42 (-67%). Cost to collect was cut nearly in half. Up till recently, AR days greater than 90 were reduced to 13.8%, well below the industry standard of 20%.

Achieving these results required a true partnership between the hospital and Firstsource. Even today, the partnership continues to strengthen and provide value, improving the hospital’s financial foundation and making it possible for AVH to better serve their community.