Driving AI-Native Banking Transformation

Financial institutions are facing pressure to digitalize legacy processes and deploy GenAI at scale to transform operations. Simultaneously, they must tackle rising fraud, tighter budgets and complex compliance requirements.

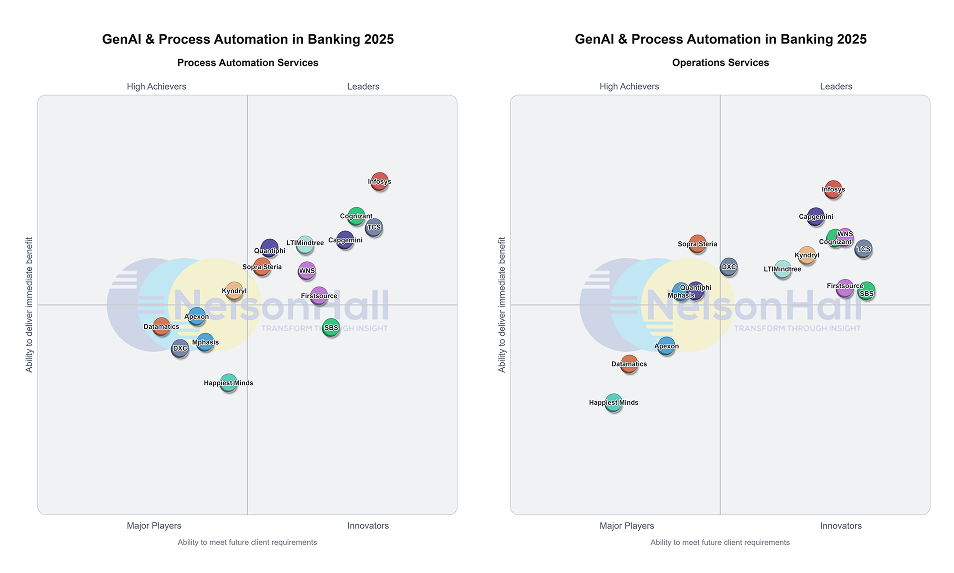

NelsonHall’s 2025 NEAT evaluation identified Firstsource as a Leader in both Operations Services and Process Automation Services for GenAI & Process Automation in Banking.

We’ve earned this recognition by combining deep domain expertise in lending with AI-first delivery to automate high-volume banking processes. We’re also enabling banks to launch new products, improve customer experiences, and reduce operational costs.

What you’ll Find in the Report

- Competitive positioning: NEAT charts and vendor performance analysis summary

- Specialized capabilities: Lending operations, mortgage services, document processing, and fraud and compliance

- Key strengths: AI-powered image and video analysis for cybersecurity, broad lending portfolio, custom regional bank solutions

- Market analysis: industry pain points, buy-side trends, and the future of GenAI in banking

Core Drivers Behind Firstsource’s Leadership

- Deep Domain Expertise in Banking Operations: 400 financial services clients with a focus on consumer mortgages, title services, customer onboarding, and operational delivery combining BPS with IT services and process transformation

- AI-First UnBPOTM Model for Banking: Tech-driven, outcome-based delivery that goes beyond labor-based services, and embeds GenAI in customer interactions, content generation, automated workflows, and knowledge management

- Three-Tier Agentic AI Strategy: Personalized goal-based money autopilots, enterprise workflow agents, and Services-as-Software (SaS) APIs with SLAs for on-demand financial actions

- Innovation Roadmap: Expanding AI solutions for sentiment, image, and video analysis, co-creating client roadmaps for change management and workforce upskilling, and deploying a digital collections platform to tackle rising delinquencies