Banking Operations in 2025: Transformation Through AI and Outcomes

As regulatory complexity grows and fraud tactics evolve, top performing banks are shifting to AI-powered operations, platform thinking, and pricing models based on real outcomes.

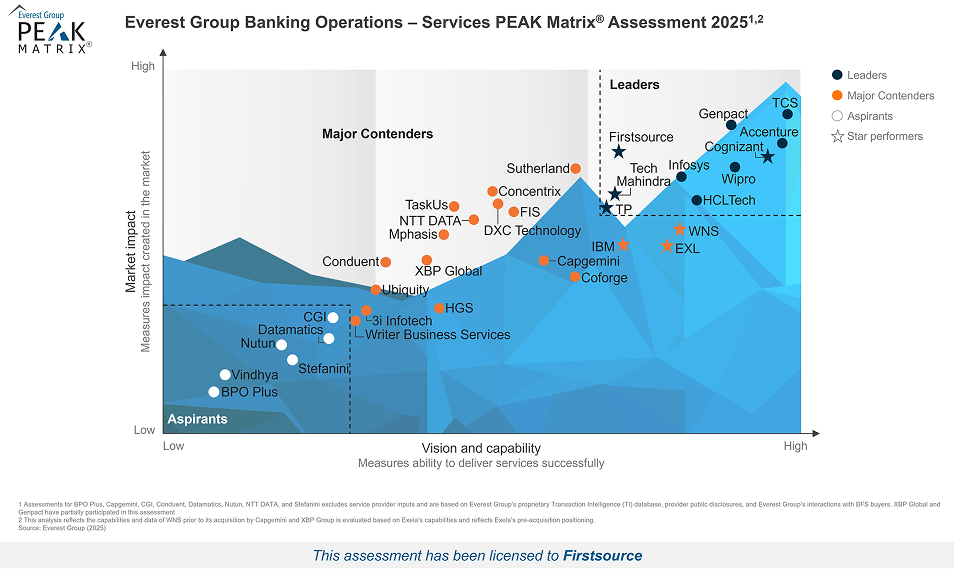

Everest Group has positioned Firstsource as a Leader in its Banking Operations – Services PEAK Matrix® Assessment 2025, while also recognizing us as a Star Performer for demonstrating the most improvement year-over-year. This dual recognition validates our UnBPO™ approach to banking transformation.

Report highlights include:

- Comprehensive assessment of 34 global providers across market impact, vision and capability, service scope, innovation investments, and delivery footprint

- Market dynamics reshaping banking services, including AI-first operating models, platformization, regulatory expansion, and outcome-based sourcing models across retail, commercial, lending, and payments

- Total banking operations services revenue reaching US$9–US$9.2 billion in the twelve months to December 2024, supported by broader BPS growth of 5.5–6.5% percent CAGR through 2030

- Why Firstsource stands out as a transformation leader, with detailed analysis of capabilities, client results, and industry partnerships

Why Firstsource Leads in Banking Operations Transformation

- Comprehensive Banking Operations Coverage: Firstsource provides end-to-end support across cards, lending, collections, and FCC, enabled by AI tools such as AI Coach, QC Copilot, and Mortgage Copilot to improve advisor performance and turnaround times.

- AI-Powered Intelligence and Platform Integration: Our proprietary Firstsource relAI suite, along with Intelligent Document Management and QC Copilot, strengthens Digital-One-Office workflows across complaints, onboarding, and fraud management. Firstsource's strongest domain capabilities lie in lending and retail banking, supported by front-to-back workflow integration across complaints, onboarding and fraud management workflows.

- AI-Enabled Fraud and Collections Innovation: We offer solutions enabling AI-driven ID verification, behavioral fraud analytics, and voicebot automation across fraud management and collections, developed in partnership wth WebID, PASABI, and Prodigal.

- AI-Enabled Fraud and Collections Innovation: We offer solutions enabling AI-driven ID verification, behavioral fraud analytics, and voicebot automation across fraud management and collections, developed in partnership with WebID, PASABI, and Prodigal.

- Outcome-Aligned Commercial Models: Our UnBPO™ framework, uses outcome-aligned pricing (including cost-per-digital and cost-per-physical minute) so fees track actual servicing effort and automation adoption, not FTE counts.