Mortgage in 2025: Winning Through AI and Operational Excellence

As origination slows and affordability tightens, leading lenders aren’t waiting for the market to rebound. They’re using AI, automation, and digital-first strategies to turn disruption into opportunity.

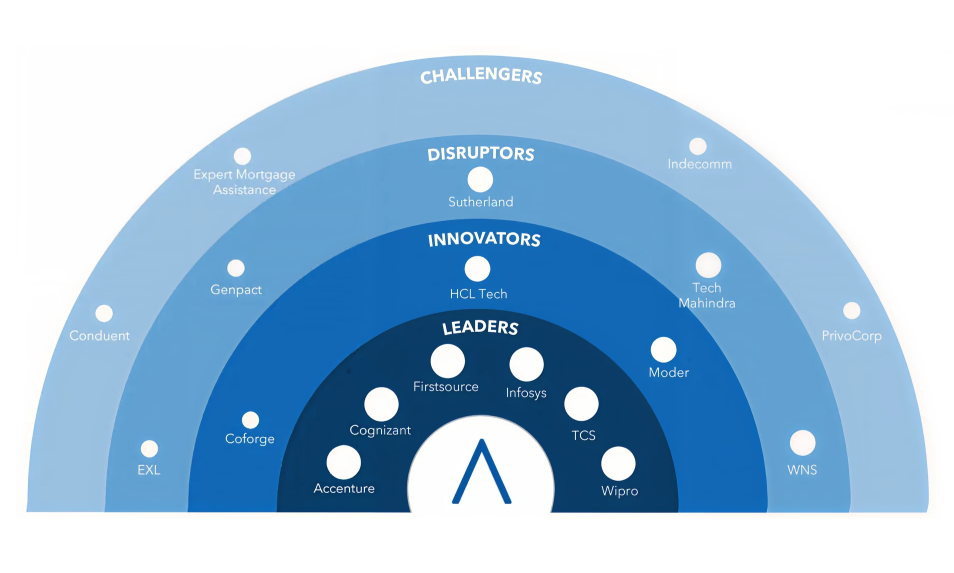

For the second straight year, Avasant has named Firstsource a Leader in its Mortgage Business Process Transformation 2025 RadarViewTM. Sourcepoint, a Firstsource company, drives our mortgage business with innovative solutions and industry expertise.

Report highlights include:

- Rigorous research methodology evaluating 70 providers, with comprehensive assessment of 18 top-tier firms across practice maturity, domain ecosystem, and investments and innovation

- Market dynamics reshaping mortgage lending, including global rate divergence, persistent affordability pressures, and volatile origination volumes

- Digital notarization, AI, and automation redefining mortgage standards, with permanent RON adoption in 45+ states, e-notes, and automated compliance to reduce costs and processing times

- Why Sourcepoint stands out as a transformation leader, with detailed analysis of capabilities, client results, and industry partnerships

Why Firstsource Leads in Mortgage Transformation

- Comprehensive Scale and Regulatory Expertise: Firstsource, through its US-based franchise, Sourcepoint, delivers end-to-end mortgage transformation across sourcing, origination, servicing, and due diligence. Licensed in 50+ states, we handle 4M+ lead capture and servicing calls, analyze 10M+ customer interactions, and process 2M+ mortgage loans and 5M+ home loans across origination channels annually.

- AI at the Core: Our proprietary platforms and Firstsource relAI enhance underwriting, compliance, and customer experience. We also leverage AI/ML, NLP, and predictive analytics to drive standardization and real-time insights across processes.

- Domain Ecosystem: Firstsource's UnBPOTM approach integrates Services-as-Software (SaS), skill-based resourcing, and AI-at-the-core capabilities. We are supported by partnerships with UiPath and Automation Anywhere for automated quality checks, intelligent document processing, and advanced analytics.

- Investments and Innovation: With planned investments of $10M–$50M in GenAI platform enhancements, AI-driven document intelligence, and strategic acquisitions, Firstsource is positioned to deliver cutting-edge mortgage transformation solutions at scale.