Leading Mortgage Transformation

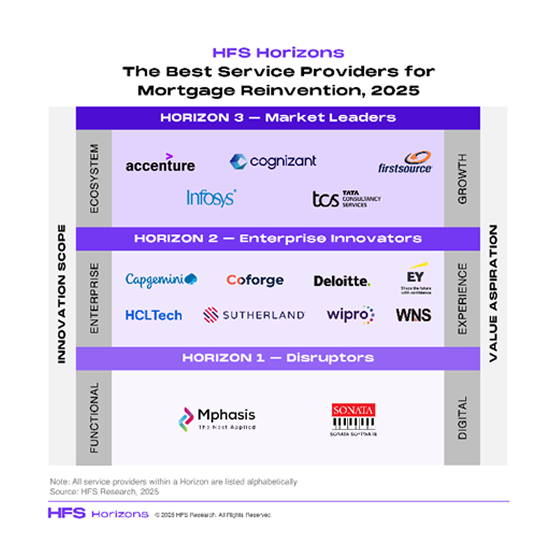

Firstsource has been recognized as a Horizon 3 Market Leader in The Best Service Providers for Mortgage Reinventions, 2025 by HFS Research.

This ranking reflects Firstsource’s proven ability to deliver end-to-end mortgage transformation, from functional digital optimization to enterprise-wide modernization and new value creation through ecosystem collaboration.

Report Methodology and Highlights

Report highlights include:

The HFS Best Service Providers for Mortgage Reinvention 2025 evaluates 15 global service providers on their ability to help lenders modernize, improve customer experience, and leverage technology to stay competitive in a compliance-heavy, volatile market.

Key dimensions include:

- Value Proposition – Strategy, differentiation, and alignment to lender priorities.

- Execution & Innovation – Breadth across origination, servicing, and capital markets with strong industry-specific IP.

- Go-to-Market – Targeting Tier 1 and Tier 2 lenders with modernization-focused investments.

- Market Impact – Scale, growth, and measurable client outcomes.

Why Leading Lenders Choose Firstsource

Global Reach & Scale

500+ mortgage clients, including 2 of the top 5 US banks and 12 of the top 20 US mortgage lenders and servicers. 8 delivery and innovation centers across the US, UK, Mexico, Philippines, and India, including an AI Center of Excellence for mortgage.

End-to-End Mortgage Expertise

Comprehensive support across origination, servicing, capital markets, title, and post-close services—serving banks, mortgage lenders, fintechs, and servicers.

Innovation-Led Solutions

- Mortgage Language Model (MLM): Proprietary GenAI model for document classification, data extraction, QC, and underwriting.

- ILM (Intelligent Loan Management): Automates setup, underwriting prep, and closing support.

- LES (Loan Evaluation System): Servicing and investor reporting audits.

- Firstsource relAI: End-to-end AI platform for domain-specific transformation.

UnBPO™ Approach

Moving beyond traditional BPO to tech-enabled, transformation-first partnerships, driving speed, transparency, and borrower-centric experiences.