Expert solutions for the industry's toughest challenges, from regulatory uncertainty to mass complaints handling

The UK motor finance industry is facing one of its most complex periods yet. The FCA's Motor Commission Investigation and Review (MCIR) has fundamentally reshaped the landscape, creating unprecedented operational demands that even industry leaders with strong compliance records cannot handle alone.

Firstsource: Your Trusted Management Partner

With a proven record in PPI complaint remediation and deep domain expertise in the motor finance industry, Firstsource is uniquely positioned to help motor finance providers respond with agility and confidence.

Motor Finance Redress Handling Process

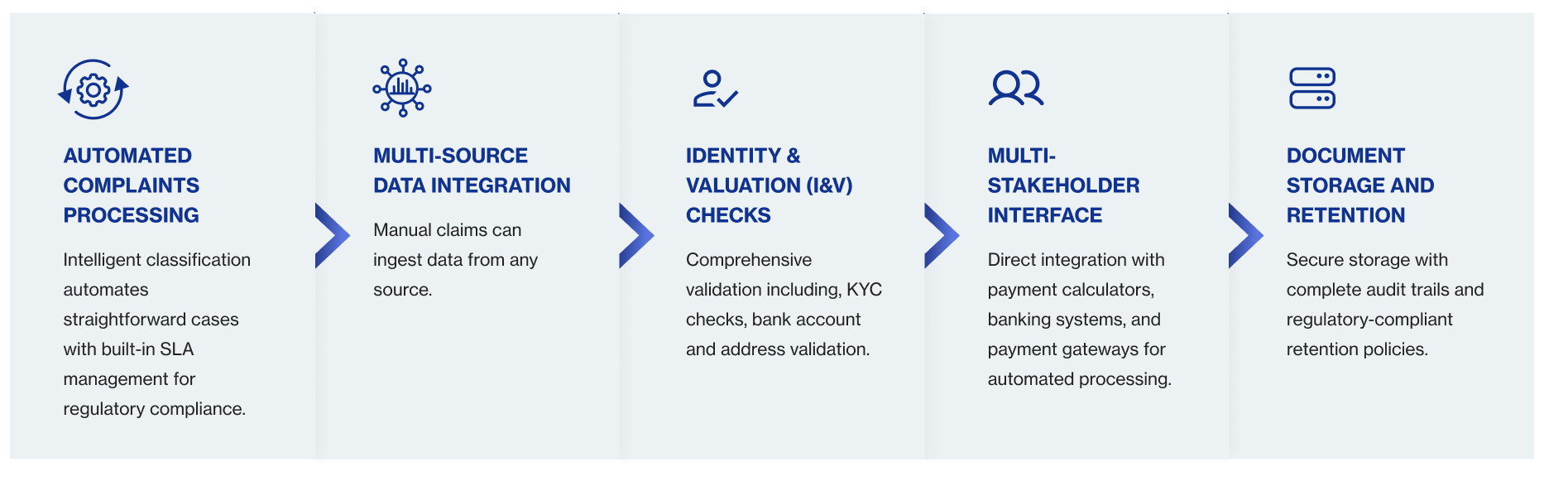

Our comprehensive motor finance redress solution combines automated processing with expert manual intervention for complex cases, ensuring fair outcomes, regulatory compliance, and stakeholder confidence.

Our Five-Step Redress Process

High-Volume Complaint Handling

Successfully managed over 250,000 complaints in just 6 months during the PPI claims period. Our UK-based teams bring sector knowledge and regulatory precision to every interaction.

Automated DSAR Processing

Streamline DSAR response times with AI-powered automation. Reduce manual overhead, minimize delays, and ensure compliance at scale.

Specialized Vulnerable Customer Support

We use AI-assisted identification and empathy-trained agents to meet Consumer Duty expectations. Support includes real-time translation, tailored scripts, and outcome-sensitive engagement.

Smart Complaint Journey Management

Our next-gen AI tools assist, not replace, agents by accelerating triage, auto-routing complaints, and keeping journeys progressing without manual bottlenecks.

Performance Metrics That Matter

- 80% of cases resolved within 20 working days

- 99% resolved within 40 days

- Measurable improvement in NPS and first-call resolution

- Reduced average handling time (AHT) during the remediation period

Operational Resilience

We help ring-fence support response teams from business-as-usual operations to ensure seamless service across all customer segments, even during peak complaint periods.

Why Firstsource?

Trusted by the UK’s Big Six banks

- Deep experience in mass complaint management, including FCA-regulated redress initiatives

- Extensive UK delivery footprint with compliant, scalable operations

- AI, automation, and digital-first solutions to prepare your operations for the future

The challenges facing motor finance providers are real, but with the right partner, they’re manageable.

Let Firstsource help you navigate today’s challenges while building resilience for tomorrow.